ILLUSTRATION & MOTION

Jibin Joseph

Siddhika Deshmukh

Abhishek Balan

Midhun Mohan

Sarath Chandran

product design

Me

Nandini Gangal

DEVELOPERS

Aravind Raj

Nikunj Sharma

Kaustav Sharma

Prateek Srivastava

/ The Challenge

Traditional banking apps make card management an afterthought. Features like freezing a card, setting limits, or generating virtual cards are often buried under layers of settings. Users struggle with unnecessary friction, leading to frustration and lack of confidence in their financial tools.

/ our approach

Designing for Simplicity and Control

Traditional banking apps often bury essential card controls in deep settings menus, making simple tasks unnecessarily difficult. We reimagined the card management experience by prioritizing visibility and ease of use. Our approach placed real-time controls at users’ fingertips, ensuring they could manage their cards with confidence and clarity

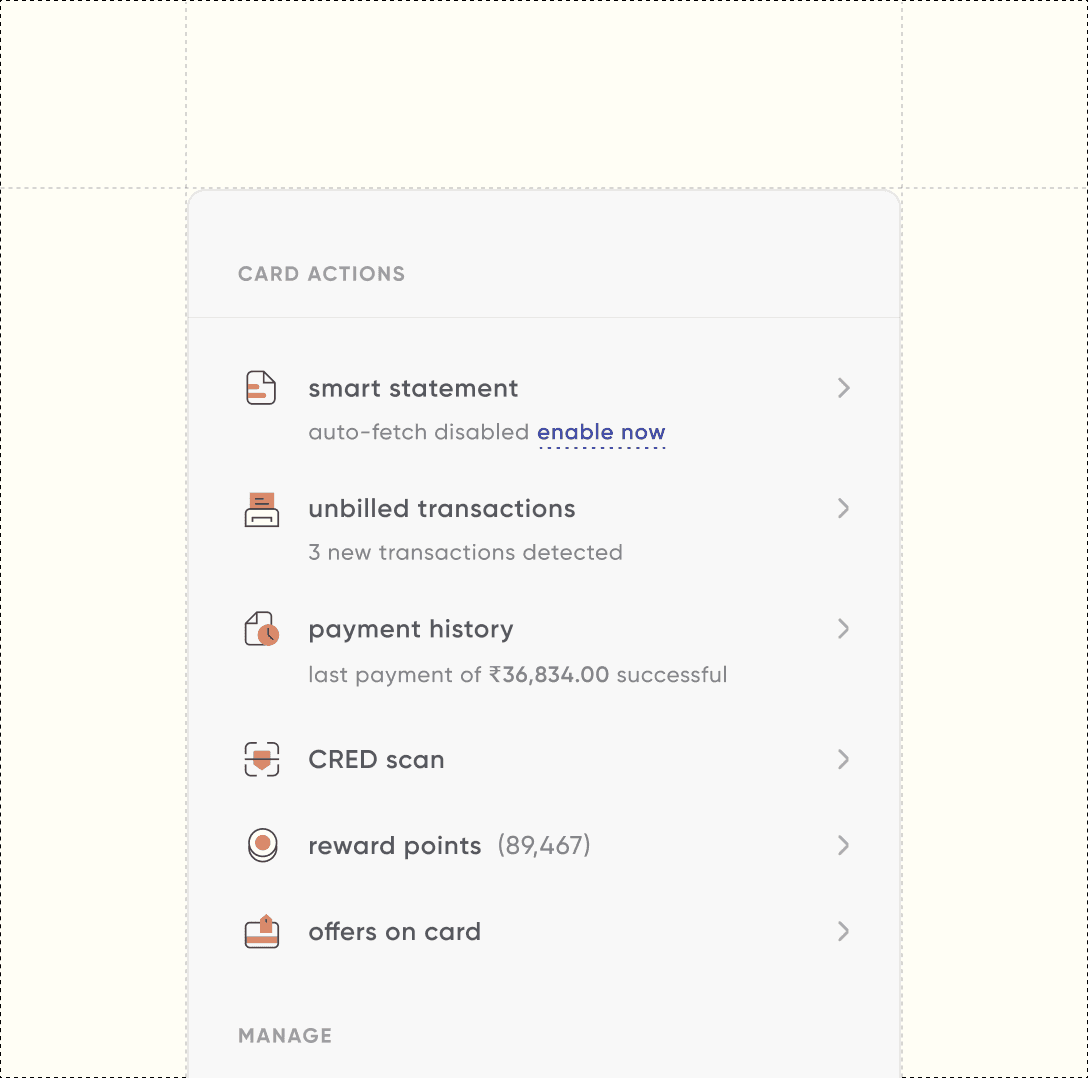

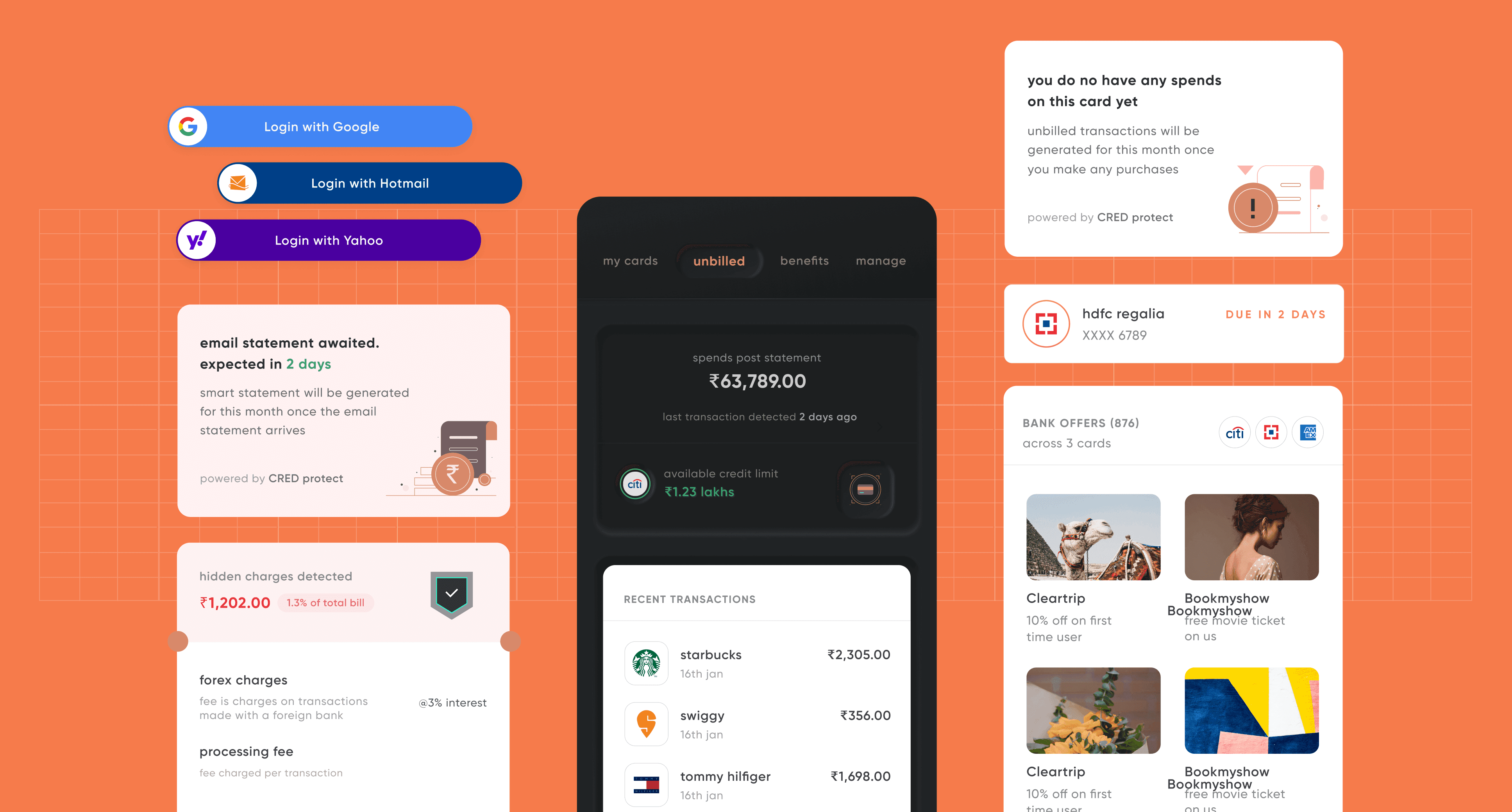

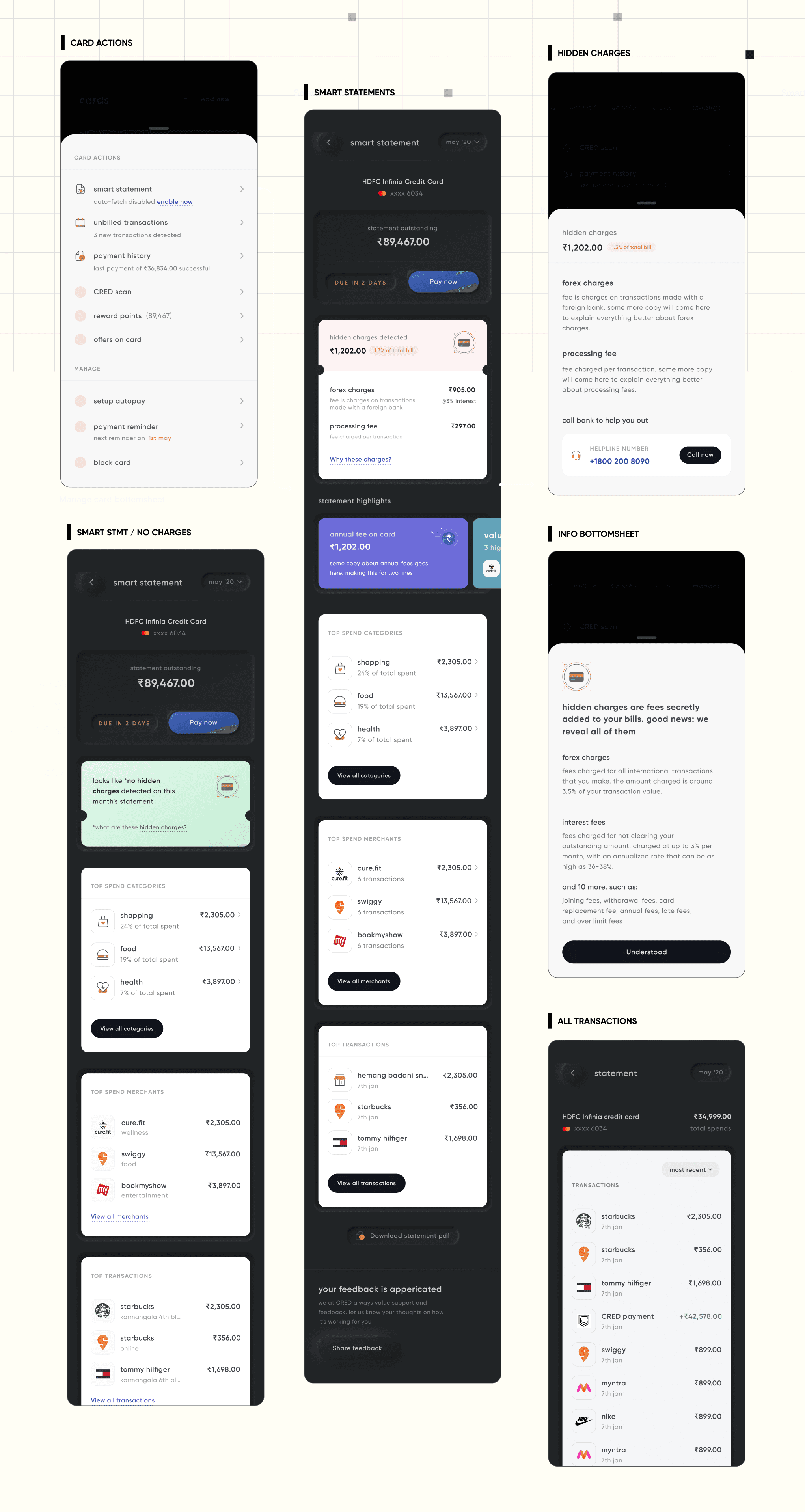

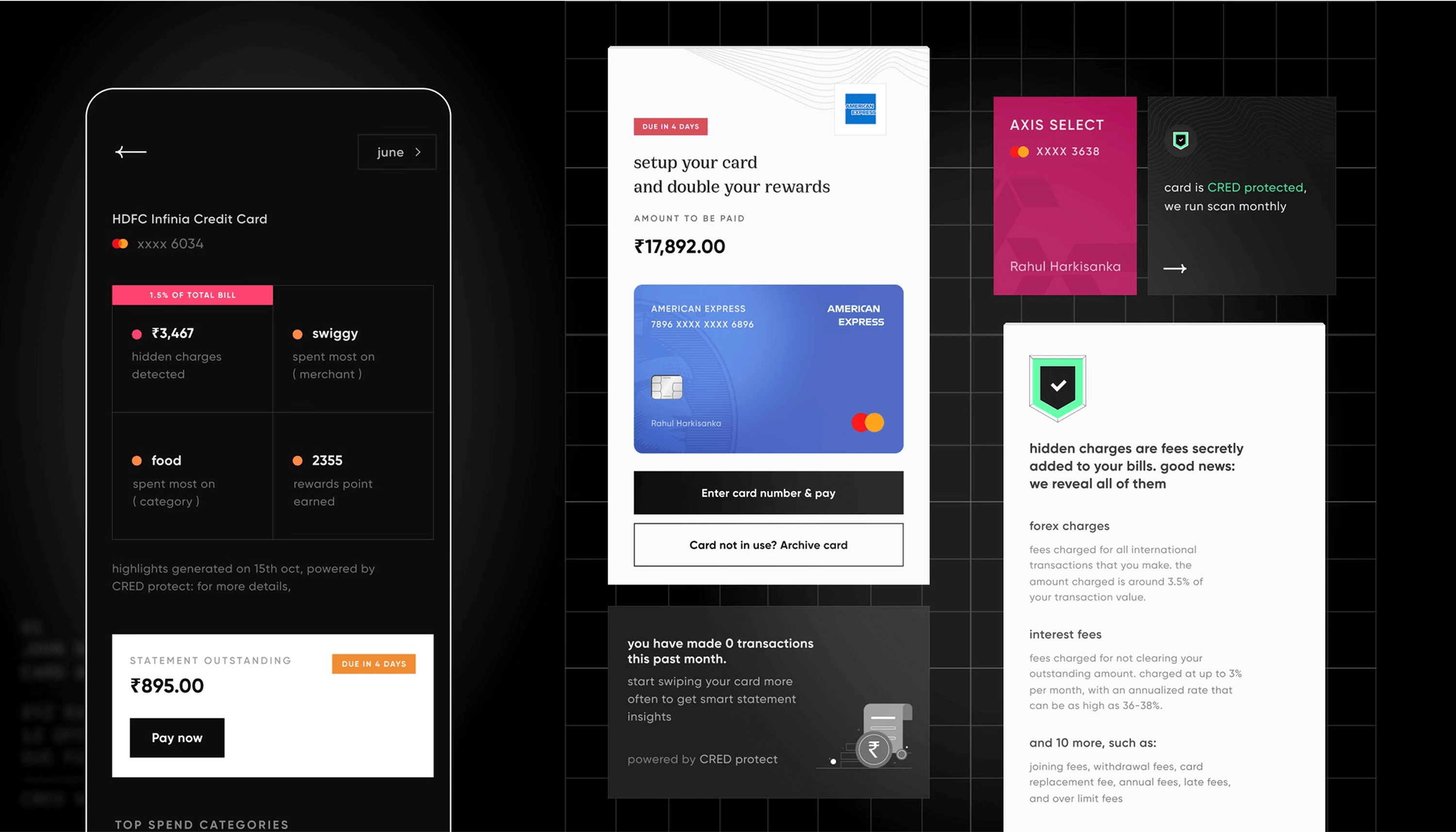

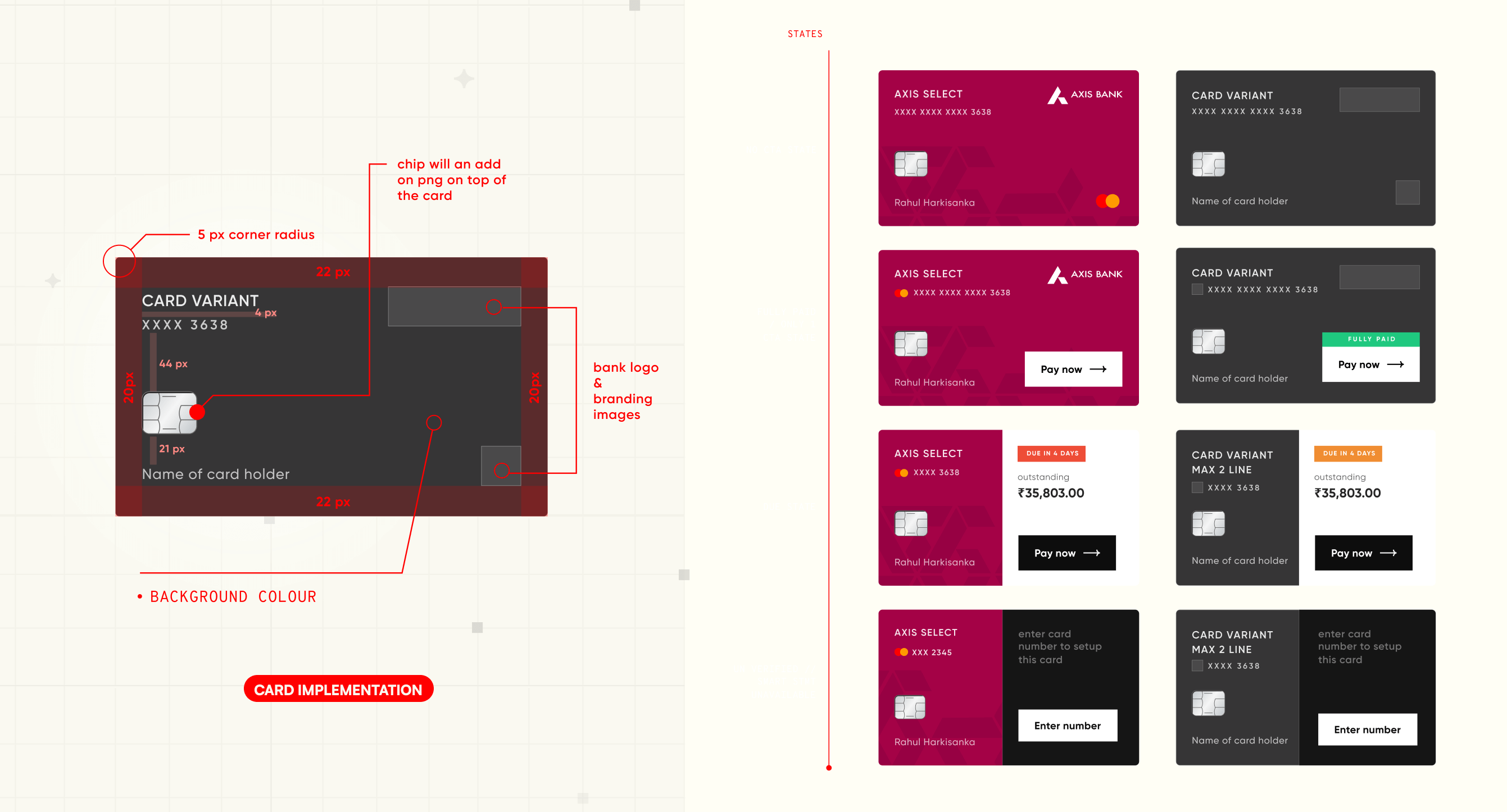

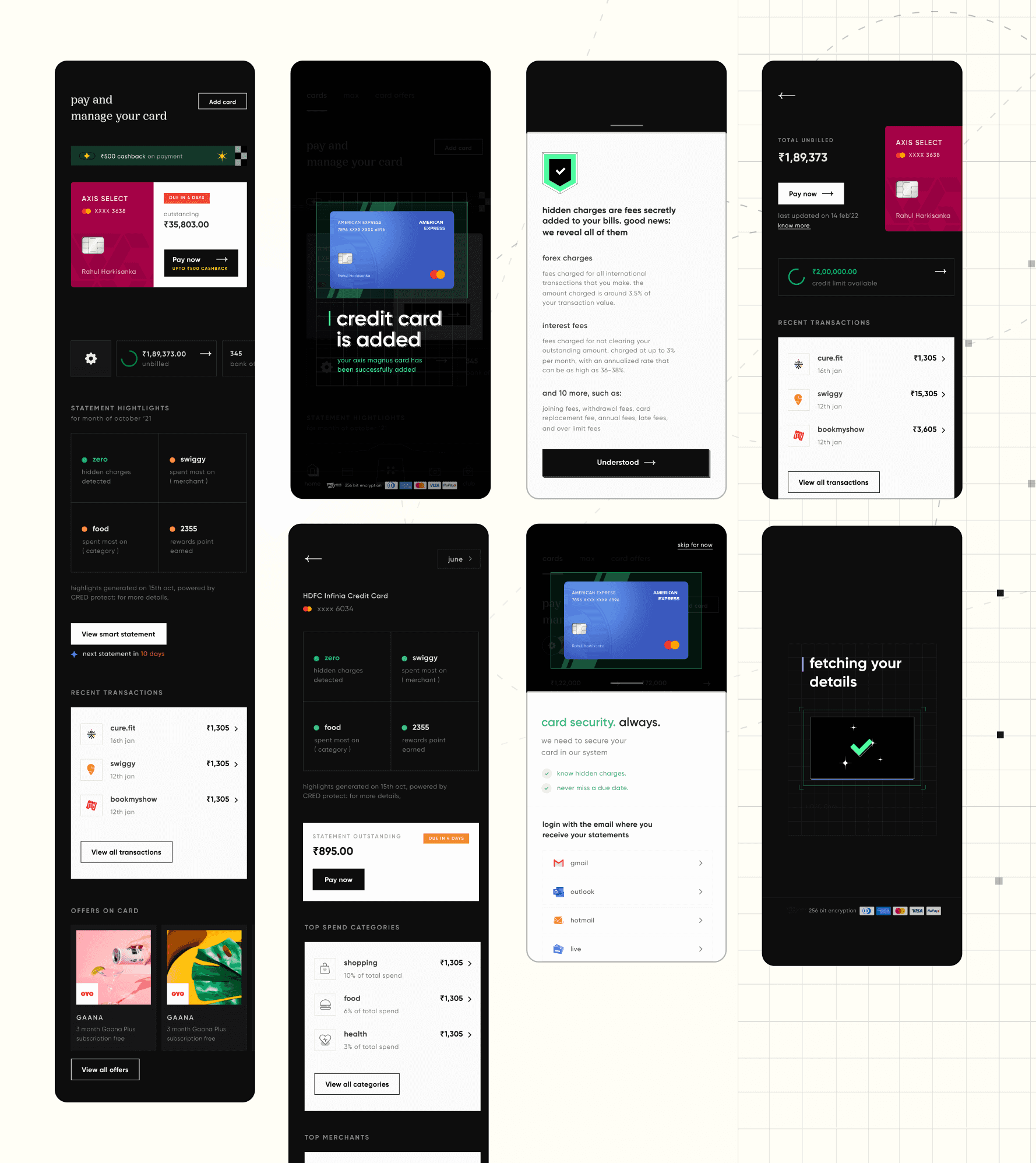

VERSION 1 / 2020-'21 / The Solution

A Future-Ready Card Management Experience

A reimagined card management experience that empowers users with greater control, security, and convenience, ensuring that managing cards is as seamless as making a transaction.

Instant control: Freeze, unfreeze, and set spending limits in seconds.

Security-first design: Biometric authentication and real-time notifications.

Seamless virtual cards: Generate, activate, and manage digital cards on demand.

Intuitive UI: A clear, simple interface that eliminates friction and guesswork.

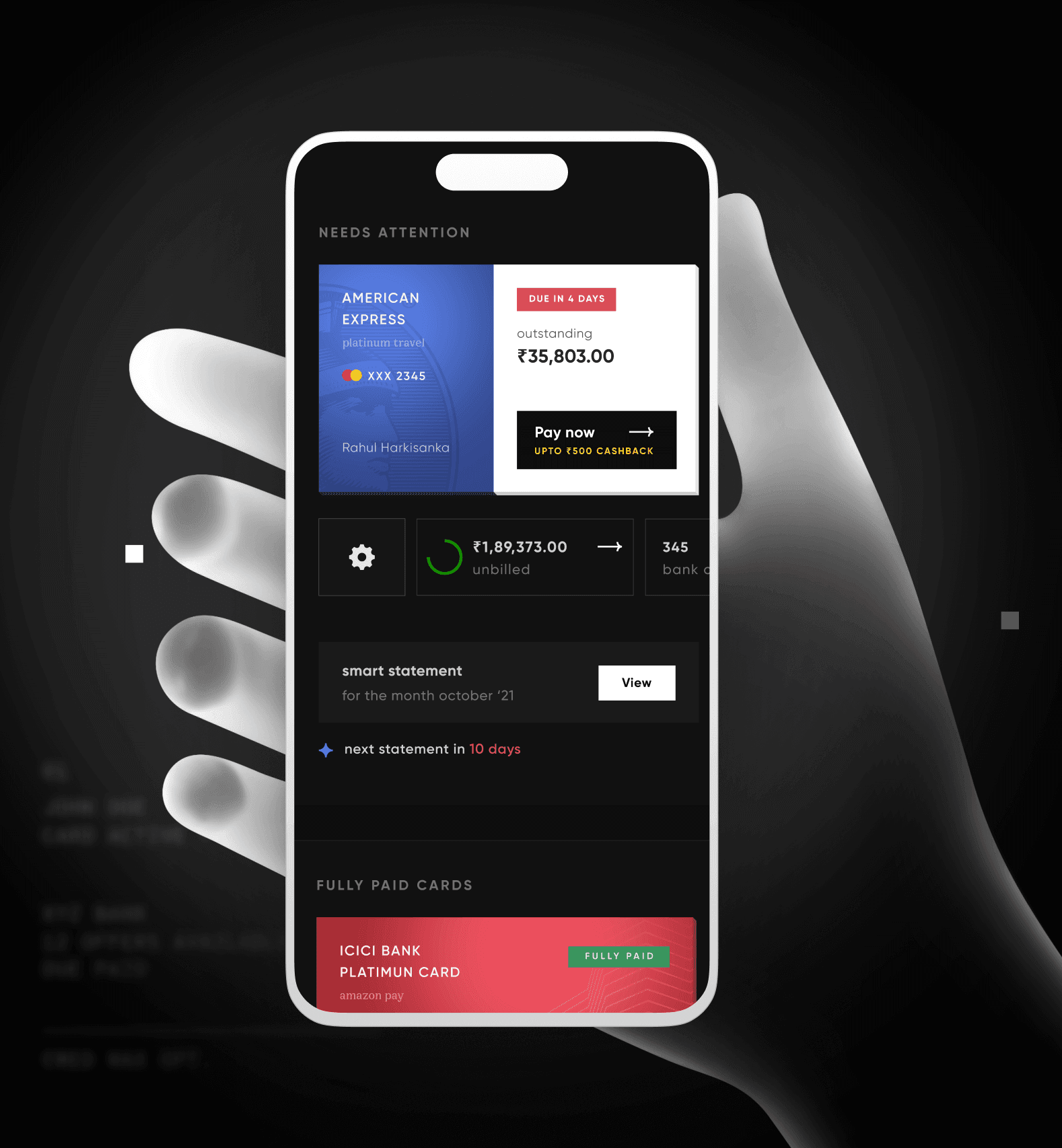

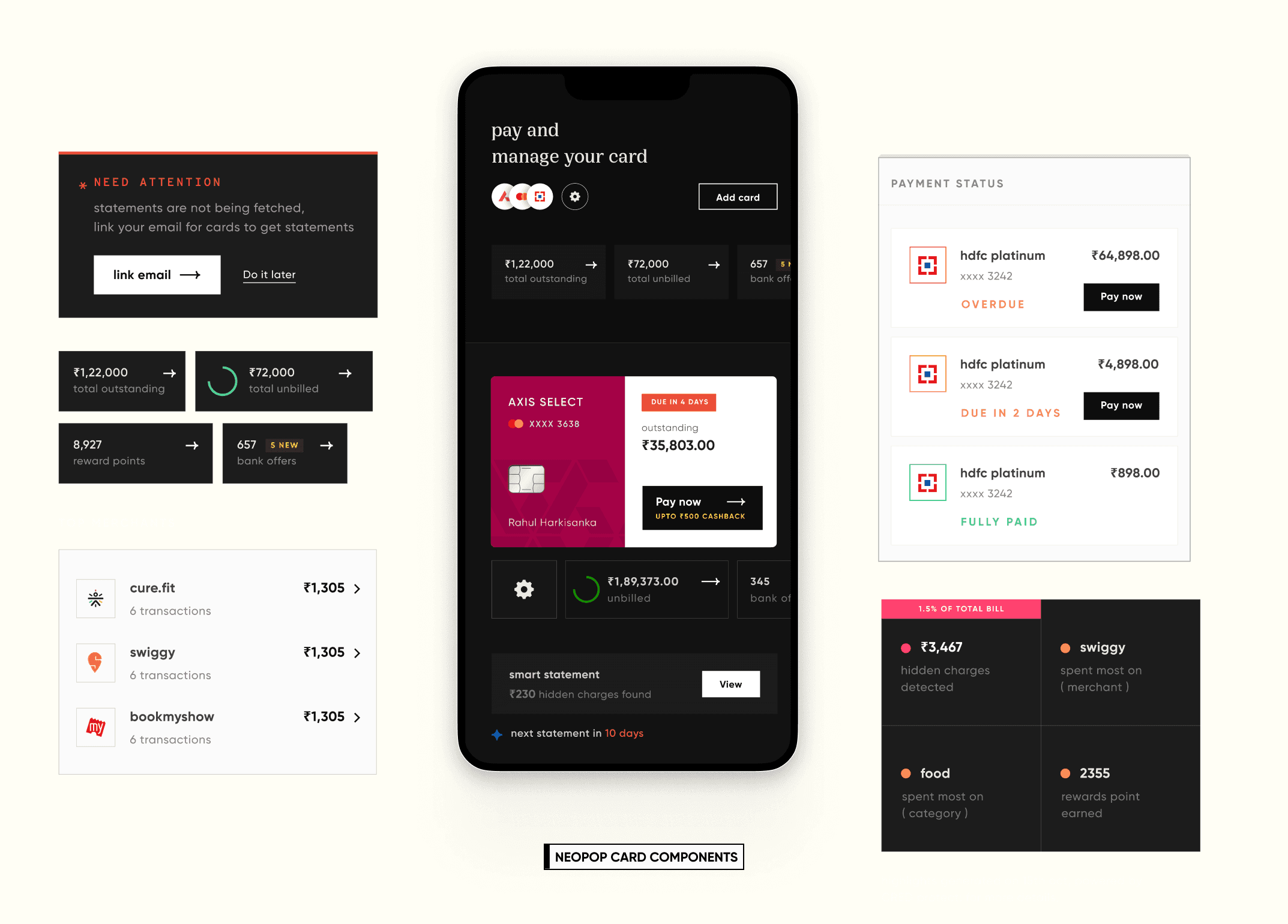

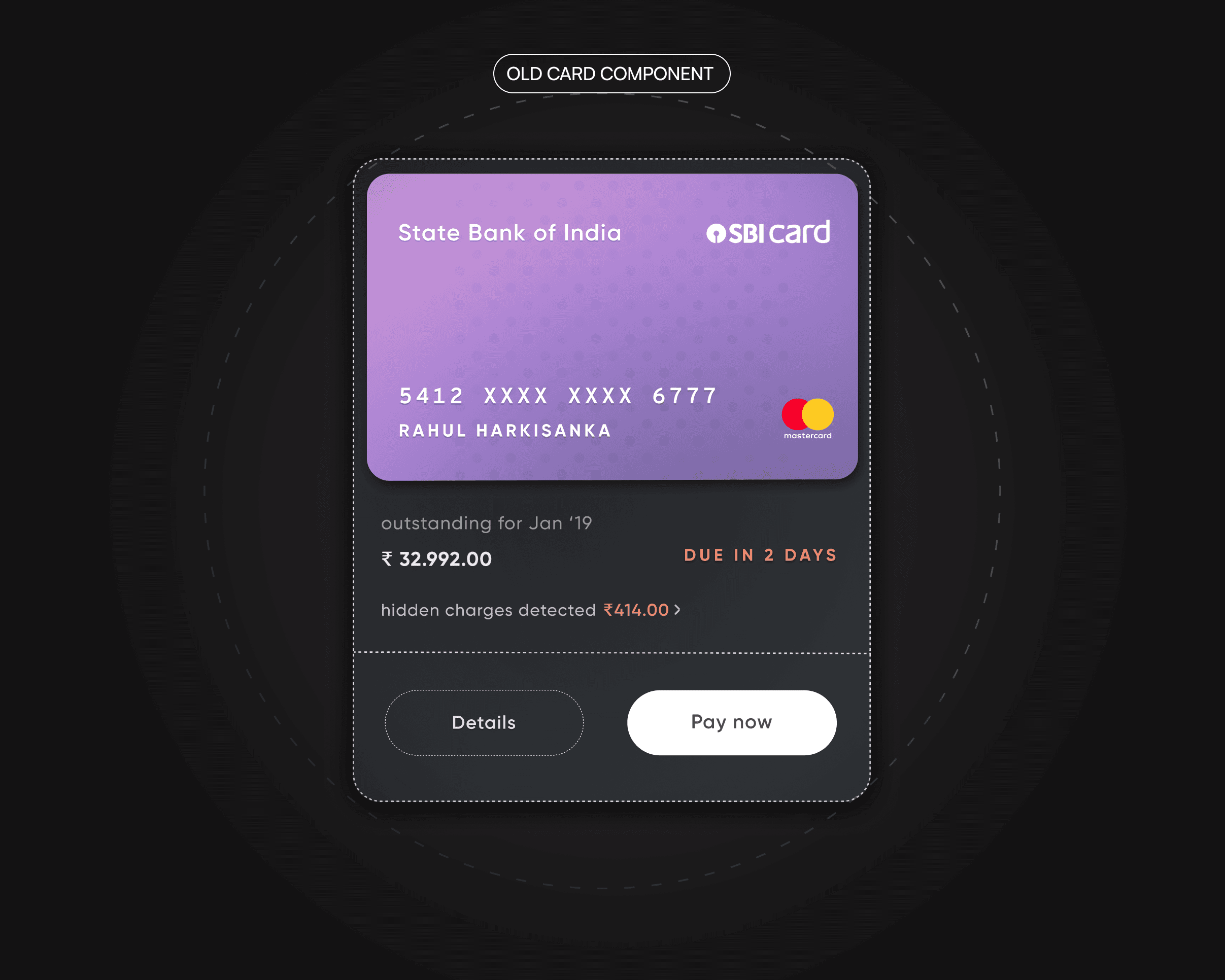

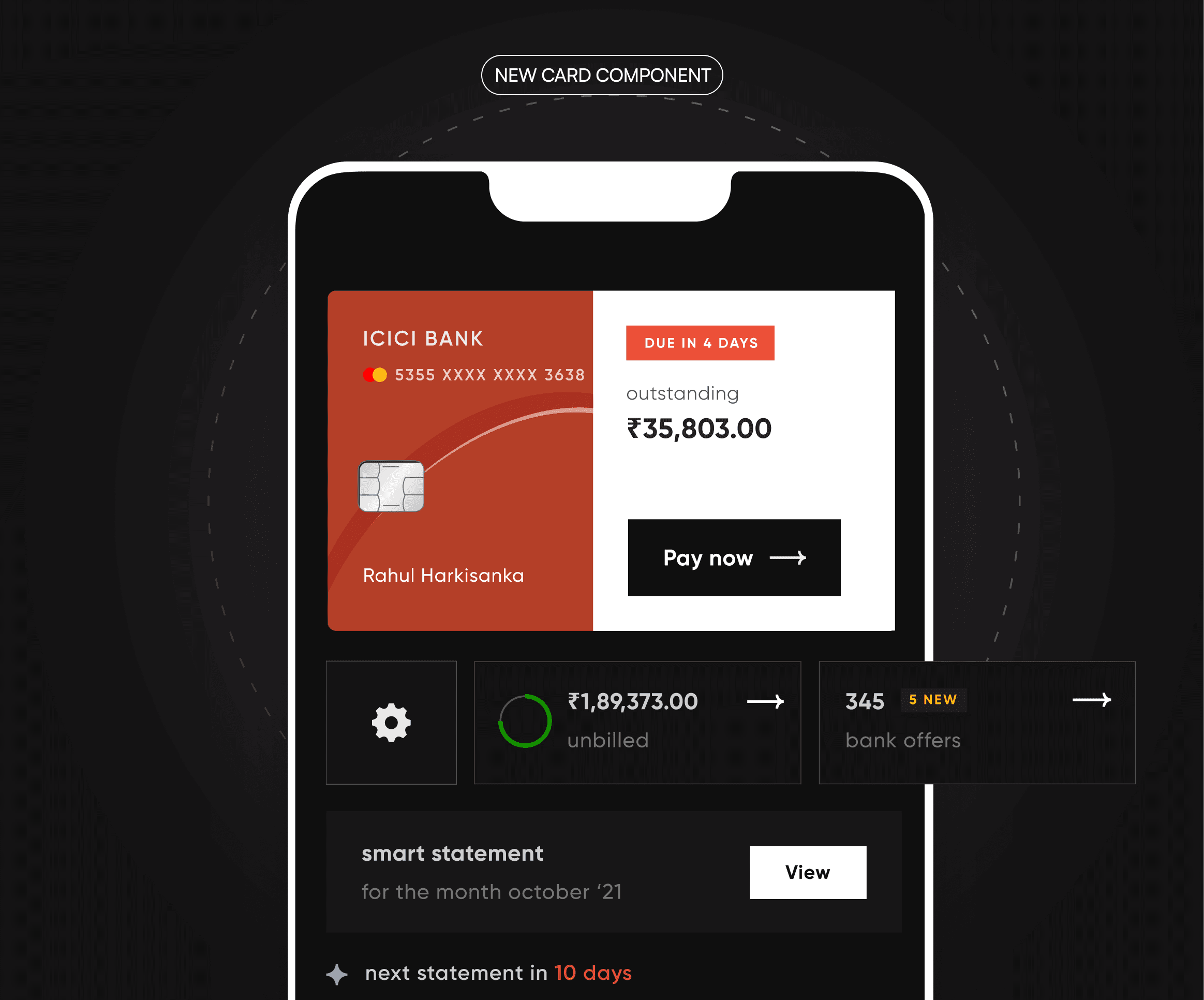

VERSION 2 / 2020-'21 / the revamp

Elevating the member Experience

To further enhance usability and visual appeal, we transitioned to the NeoPop design system. This bold, futuristic aesthetic brought greater clarity and hierarchy to the interface, improving accessibility and engagement. With striking color contrasts, fluid animations, and simplified iconography, NeoPop helped create a more immersive and intuitive banking experience.

/ our approach

Refining Through Real-World Insights

A key part of our process was gathering feedback from real users. Through multiple rounds of testing, we identified pain points and iterated on the design to maximize clarity and efficiency.

Beyond aesthetics, we optimized the system for high performance and scalability. Our architecture ensures seamless handling of real-time updates, transaction loads, and future feature expansions.

/ User Feedback

Refining Through Real-World Insights

A key part of our process was gathering feedback from real users. Through multiple rounds of testing, we identified pain points and iterated on the design to maximize clarity and efficiency.

Beyond aesthetics, we optimized the system for high performance and scalability. Our architecture ensures seamless handling of real-time updates, transaction loads, and future feature expansions.

/ MEASURED IMPACT

13m card users

42%

users with 2 or more card.

all cards

Billion generated in revenue last year

footnote : GROWING UP WITH A PRODUCT

⚘

CARD MANAGEMENT'S GROWTH ALSO IN SOME WAYS REFLECTS MY GROWTH FROM AN INTERN TO A SENIOR DESIGNER. I AM QUITE PROUD OF HOW MY ROLE EVOLVED IN THIS PROJECT AND HOW IT IMPACTED ME AS A DESIGNER.

WORKING WITH MY MANAGER, NANDINI GANGAL ON THIS WAS SOMETHING THAT I AM REALLY GRATEFUL FOR SO IN A WAY THIS PROJECT GAVE ME A FRIEND FOR LIFE.

view next project

stablemoney

Stablemoney: India's premier digital financial platform.

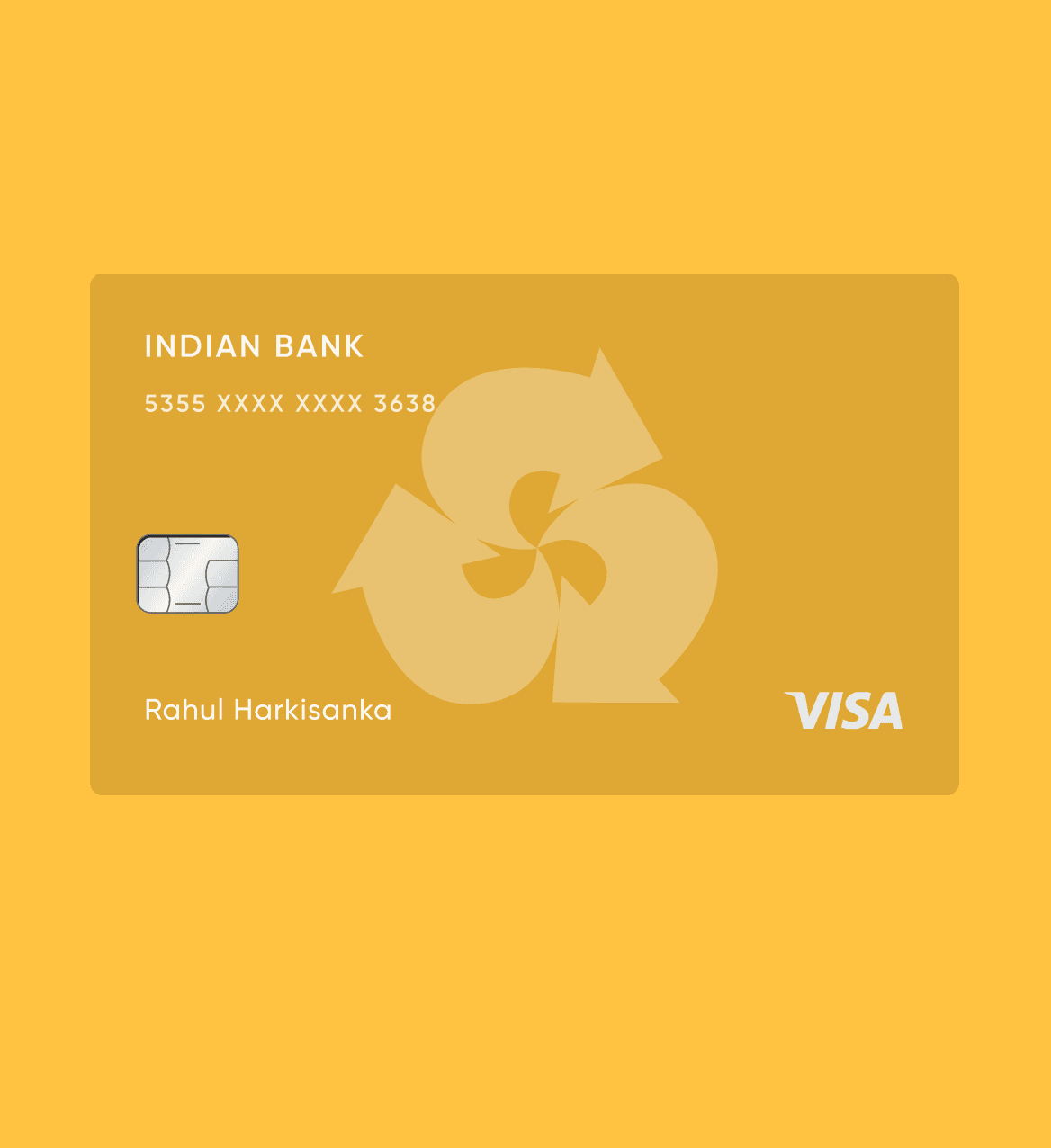

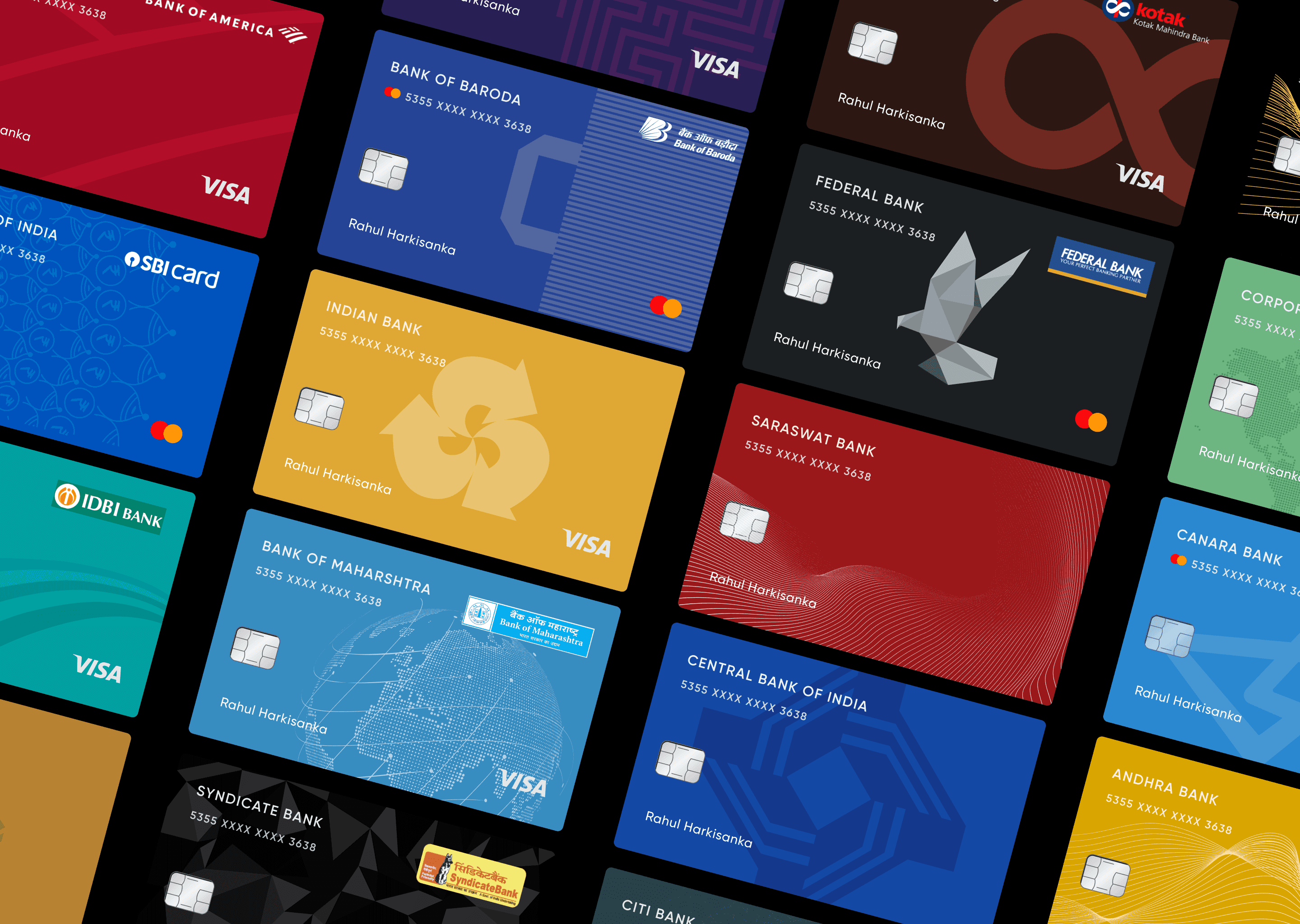

CREDIT CARD MANAGEMENT

CRED's Card management product help users track spending, manage payments, and stay in control of their finances.

ROLE / SR. PRODUCT DESIGNER

UI DESIGN / UX DESIGN / PRODUCT STRATEGY

I joined CRED in 2020 as an intern and later co-led the Card Management team by 2023.